Toyota Harrier Hybrid available for import

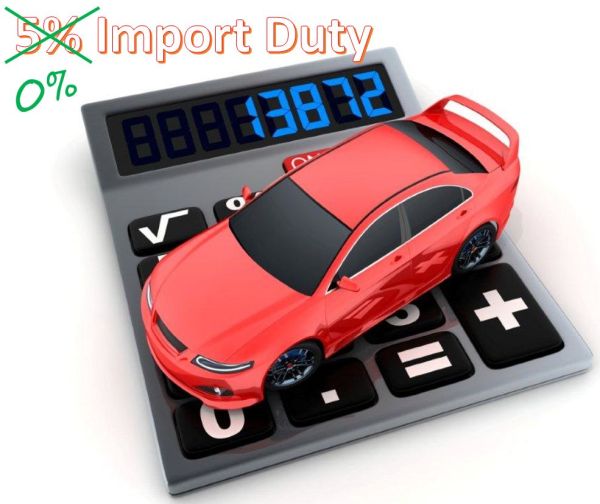

From 1 January 2018 the 5% import duty will no longer apply to vehicles originating from Japan and the USA.

A simple Certificate of Origin form must be submitted to Australian Customs at the time of completing the import entry.

Removal of the 5% import duty represents a significant saving on the import of vehicles, particularly expensive ones such as GT-R’s for which the total price could end up being more than $4,000 cheaper.

Typical savings to be expected:

$1,000 saving on a $30,000 vehicle

$1,500 saving on a $40,000 vehicle

$2,000 saving on a $50,000 vehicle

There will be a further saving for vehicles that trigger the Luxury Car Tax (LCT) threshold ($65,094 for normal vehicles and $75,526 for fuel efficient vehicles (2017-18 financial year)), as the import duty forms part of the LCT calculation.

The duty will also be lifted on goods from 8 other countries with which Australia has Free Trade Agreements (FTA’s):

China, Republic of Korea, New Zealand, Singapore, Thailand, Chile, the Association of South East Asian Nations (ASEAN) (with New Zealand) and Malaysia.

Unfortunately vehicles manufactured in Europe and the UK will – for now – continue to attract the 5% import duty unless they are over 30 years old.

10% GST still applies to the import of all vehicles over $1,000 value.

Related posts